Support at Home will provide eligible seniors with better support to live at home for longer. But what will it cost? Let’s look at how participant contributions work, and how much you will pay for home care services under the new Support at Home program.

Support at Home program recipients will contribute their own funds to help the government pay for the delivery of home care services. This will allow more people to access subsidised care services and ensure that those people with higher needs, and less income, receive the support they need.

What is a Support at Home Contribution?

A Support at Home contribution is the portion of the cost of certain home care services that you pay yourself, while the Australian Government pays the remainder.

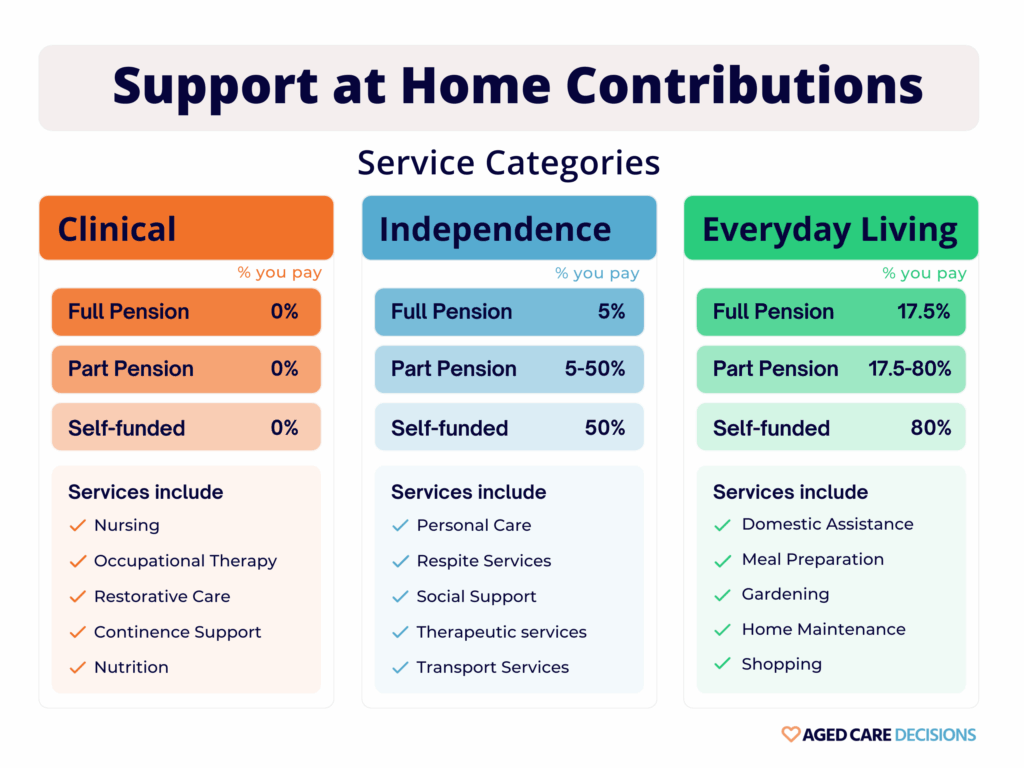

Under the Support at Home program, the government fully funds all approved clinical care services, such as nursing and allied health. For non-clinical services, including everyday living and independence supports, you may be required to contribute a percentage of the service cost.

Your contribution is the out-of-pocket amount you pay for approved services delivered under your care plan. The contribution amount depends on:

- The type of support you receive

- Your pension and income status

- The outcome of any required income and assets assessment

Not everyone pays the same contribution, and some people may pay nothing for certain services.

Support at Home contributions are separate from provider service prices and are designed to ensure government funding is directed to those with the highest care needs and lowest financial capacity.

A lifetime cap of $130,000 applies to non-clinical care costs. This means that across your lifetime, you will not pay more than $130,000 in total contributions for non-clinical services, whether you receive care at home or later move into residential aged care.

Once this cap is reached, the government will cover the full cost of approved non-clinical services.

How Are Support at Home Contribution Rates Determined?

Your pension status will determine your Support at Home contribution rate. Full pensioners will pay the lowest contribution while self-funded retirees will need to contribute more for their care.

To protect self-funded retirees with lower incomes, seniors who are eligible for a Commonwealth Seniors Health Card (CSHC) will have lower contributions than those who are not. This lower rate will apply regardless of whether you have applied for a CHSC.

Different types of supports and services have different contribution rates applied:

Clinical services including nursing care and allied health services | Independence supports such as mobility assistance and transport | Everyday living services such as domestic assistance and social supports | |

Full pensioner | 0% | 5% | 17.5% |

Part pensioner | 0% | Between 5%-50% based on an assessment of income and assets. | Between 17.5%-80% based on an assessment of income and assets |

Self-funded retiree eligible for a CSHC | 0% | Between 5%-50% based on an assessment of income and assets. | Between 17.5%-80% based on an assessment of income and assets |

Self-funded retiree not eligible for a CSHC | 0% | 50% | 80% |

Read more: Participant contributions.

The mix of services and supports you receive will be based on your assessed and approved care plan, and the arrangements made by your home care provider.

Aged Care Decision’s FREE support service can assist you to navigate these changes and secure a provider that can help you make the most of your Support at Home budget.

The examples below illustrate how much you will need to contribute, according to your circumstances.

Our custom software can take your care needs, location, budget, and personal preferences and match you with available home care providers in your area. We can then send you a tailored options report that you can use to compare different home care providers quickly and easily.

Full Pensioner Contributions Under Support at Home

If you’re a full pensioner, you will never be asked to pay more than you can afford. This is what you can expect to contribute towards in-home care services you receive under Support at Home:

❌ Daily care fee | There is no daily care fee payable |

❌ Income tested fee | As a full pensioner you won’t be means-tested and will not pay income-tested fees |

❌ Clinical supports | All clinical support services, such as nursing care, medical supplies, and allied health services, are fully covered by the government. |

✅ Independence supports | You will pay a 5% contribution towards the cost of independence support services. This can include assistance with showering and dressing, mobility support, medication management and transport. For example, if a home care worker assists you with transport for 2 hours per week at $50 per hour, you will pay $5 and Support at Home will pay the remaining $95 |

✅ Daily living supports | You will pay a 17.5% contribution towards the cost of daily living supports. This can include house cleaning, laundry, meal preparation and meal delivery services, gardening, and social supports. For example, if you receive home delivered meals for $200 per week, you will pay $35 and Support at Home will pay the remaining $165. |

Part Pensioner Contributions Under Support at Home

If you are a part pensioner you must complete an income and assets assessment, which will determine whether you will pay an income tested fee.

This is what part pensioners can expect to contribute to in-home care services received under Support at Home:

❌ Daily care fee | There is no daily care fee payable |

✅ Income tested fee | As a part pensioner, you may be required to pay an income-tested care fee, depending on your assessable assets and income. |

❌ Clinical supports | All clinical support services, such as nursing care, medical supplies, and allied health services, are fully covered by the government. |

✅ Independence supports | You will pay between 5%-50% as a contribution towards the cost of independence support services. This can include assistance with showering and dressing, mobility support, medication management and transport.

For example, if a care worker assists you with daily showering at a cost of $400 per week, you will pay between $20-$200 and Support at Home will pay the balance.

|

✅ Daily living supports | You will pay between 17.5%-80% as a contribution towards the cost of daily living supports. This can include house cleaning, laundry, meal preparation and meal delivery services, gardening, and social supports.

For example, if you receive a cleaning service at a cost of $200 per week, you will pay between $35-$160, and Support at Home will pay the balance.

|

Self-Funded Retiree Contributions Under Support at Home

As a self-funded retiree, you must complete an income and assets assessment, and if you are over a minimum threshold, you will pay an income-tested fee. This fee depends on your assets and income and is capped at $13,724.45 per annum.

{note: the fee cap may change with the new Schedule of fees on 1 July}

As mentioned earlier, self-funded retirees who are eligible for a Commonwealth Seniors Health Card (CSHC) will have lower contributions than those who are not.

If you are a self-funded retiree and you ARE eligible for a CSHC, you will make similar contributions towards independence and daily living supports as a part pensioner (between 5%-50% for independence supports and between 17.5%-80% for daily living supports).

This is what self-funded retirees who are NOT eligible for a CSHC can expect to contribute to in-home care services received under Support at Home:

❌ Daily care fee | There is no daily care fee payable |

✅ Income tested fee | As a self-funded retiree, you will likely be required to pay an income-tested care fee |

❌ Clinical supports | All clinical support services, such as nursing care, medical supplies, and allied health services, are fully covered by the government. |

✅ Independence supports | You will pay a 50% contribution towards the cost of independence support services. This can include assistance with showering and dressing, mobility support, medication management and transport.

For example, if you are approved for assistance with your medication management, at a cost of $100 per week, you will pay $50 and Support at Home will cover the other half of this cost.

|

✅ Daily living supports | You will pay an 80% contribution towards the cost of daily living supports. This can include house cleaning, laundry, meal preparation and meal delivery services, gardening, and social supports.

For example, if you have your laundry done weekly, at a cost of $100, you will pay $80 and Support at Home will cover the remaining $20.

|

Are You a Self-Funded Retiree? Here’s How Support At Home Can Help

Previously, self-funded retirees faced significant out-of-pocket costs under the Home Care Package (HCP) system due to income-tested fees applied across all services. This often made it too expensive even to consider an assessment, let alone access care. However, with the new Support at Home (SaH) program, self-funded retirees will no longer pay fees for clinical care. This is a major shift, making government-funded home care much more accessible and financially viable.

Who sets the prices for services?

Between 1 July 2025 and 30 June 2026, individual home care providers can set their own prices for services, as they do under the Home Care Packages program. They are required to publish their standard prices on their websites and in the My Aged Care Find a Provider tool.

Using this tool can help you compare service costs and make informed decisions about your care.

On 1 July 2026, the government will introduce price caps on services to standardise costs and ensure fairness across the sector. These caps will apply to the entire cost of delivering a service, including administration fees, transport for workers and package management.

Will my Support at Home contributions change if I already have a Home Care Package?

No. What you pay will not change, but the services you receive might.

The government’s No Worse Off Principle means that if you currently have a Home Care Package your out-of-pocket expenses will not increase under the new Support at Home system.

Before 1 July 2025, your provider must clearly explain to you any changes to your prices under Support at Home. You will be asked to agree to the prices – and the hours of care your budget can deliver – as part of a new service agreement.

You do not have to sign an agreement if you are unhappy with the prices or if you don’t understand why their prices are changing. However, you do need to have an agreement in place with a provider of your choice before you are able to receive services through Support at Home.

Support at Home Contributions, Fees and Service prices explained

Under the Support at Home program, it is important to understand the difference between contributions, income-tested care fees, and service prices, as these terms refer to different parts of the cost of your care.

Contributions

A Support at Home contribution is the portion of the cost of certain approved services that you pay yourself. Contributions apply to non-clinical services such as independence and everyday living supports and are calculated as a percentage of the service price based on your pension and income status.

Income-Tested Care Fees

Some people may also be required to pay an income-tested care fee. This fee applies mainly to part pensioners and self-funded retirees whose assessable income and assets are above the minimum thresholds set by the government.

Full pensioners do not pay an income-tested care fee.

Whether you are required to pay this fee, and how much you pay, is determined through an income and assets assessment. The assessment considers factors such as:

- Income from pensions, superannuation, or investments

- The value of certain assets

Income-tested care fees are:

- Separate from service contributions

- Not linked to individual services you receive

- Capped annually and over a lifetime to limit how much you can be asked to pay

These caps are designed to protect people from paying unlimited amounts for care over time.

Service Prices Set By Providers

Home care providers set the price of each service they deliver. This price reflects the total cost of providing the service, including staffing, administration, and other associated costs. Your contribution is calculated as a percentage of this price, with the government paying the remaining amount.

Understanding the difference between these three elements helps explain why two people receiving similar services may pay different amounts under the Support at Home program.

How Support at Home contributions are collected and paid

Support at Home contributions are paid directly to your home care provider as part of the cost of delivering approved services. The government pays its portion of the service cost separately.

How you are billed

Your provider will invoice you for any contributions you are required to pay. This is usually done:

On a weekly, fortnightly, or monthly basis

After services have been delivered

As part of your regular service statement or invoice

The invoice should clearly show:

The service price

The government-funded portion

Your contribution amount

How payments are made

Most providers offer several payment options, which may include:

Direct debit

BPAY

Bank transfer

Your provider must explain how payments are collected before services begin and include this information in your service agreement.

Can contribution amounts change?

Your contribution amount may change if:

Your income or assets change

Your pension status changes

The mix or type of services you receive changes

Any changes to what you are required to pay must be explained by your provider before they take effect.

What you should expect from your provider

Your provider is required to:

Clearly explain your contribution obligations

Provide itemised statements showing how costs are calculated

Notify you of any changes to pricing or contributions

If you do not understand an invoice or believe a charge is incorrect, you have the right to ask for clarification before paying.

Aged Care Decisions can assist you to navigate all stages of the home care process, including the transition to Support at Home. Our 100% FREE service helps tens of thousands of families every month, and our professional home care experts are ready to get you started.

Read more: Support at Home Guidelines